JUSTSWAP: DeFi Done Right

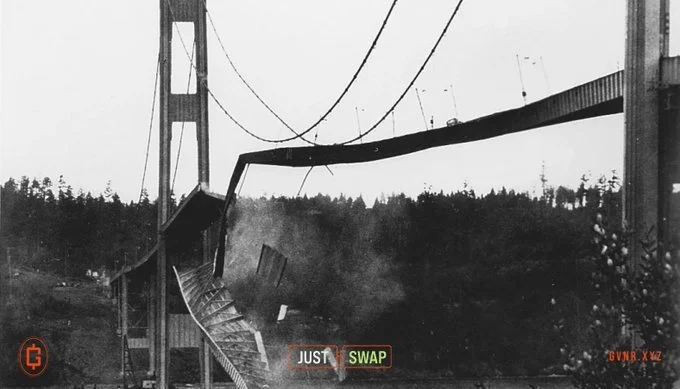

Ever since the inception of different blockchains and the successful building out of their respective ecosystems, we’ve had an issue. Sometimes it’s a niggle, an inconvenience, a waste of time, but sometimes it’s much more serious, money is lost, things are broken and trust is gone.

First Solutions

When you look back into the comparatively short history of the Web3 space, you can clearly see issues arising as early as 2016. The rise of other cryptocurrencies, other than the dominant player, bitcoin, was taking place. They were competing ecosystems, yes, but, their users, well, they wanted to move their funds around - this led to the rise of Wrapped Tokens.

The first major wrapped token was WBTC, allowing users to use their Bitcoin on Ethereum. For anyone not in the know, wrapping allows you to lock your asset, in this case BTC, and mint the wrapped version on the other blockchain of choice. This solution, although workable, has a few major issues.

With any wrapping of a token, you are giving your asset over to a custodian and putting your trust in them. With hacks in the space prevalent, those locked tokens can end up in the hands of bad actors, leading to the evaporation of value in the wrapped version of the asset. After all, if you can’t claim the underlying asset back, the wrapped version is worthless and very quickly unredeemable. Worse still, many tax authorities deem wrapping an asset as a disposal, leaving you liable for capital gains tax

(*This is not tax advice - DYOR here)

Building Blocks

As the crypto space grew, and more blockchains were introduced, so too did the need to build upon wrapped tokens, to grease the liquidity between these growing chains. This saw the introduction of Bridges in 2019-2020. Binance, Ren, and Thorchain came up with novel solutions that meant you sometimes didn’t even need to wrap your token to bridge it. These highways between chains became the norm, despite them being hacked, having huge downsides, and massive risks, what else could anyone do?

These solutions might be cumbersome, they might be risky, but they are, after all, a solution nevertheless.

But we are in an age of huge advancement, and the Web3 space never sleeps, it never rests, and it is constantly looking for that smoother solution. That is why, after years of digital blood, digital sweat, and in some cases in-real life tears, we are proud to announce JUSTSWAP.

The ultimate goal is - No bridges, no wrapping, just, well, swapping.

Breaking down JUSTSWAP

Let’s be clear: bridges are still part of the picture.

Today, if you want to move assets across chains, you’re often forced to interact with multiple venues, wrap tokens, or trust a third party to get your funds where they need to be. It’s clunky. Risky. Inefficient.

JUSTSWAP doesn’t eliminate bridges (yet), but it does eliminate the friction.

By offering a single interface that plugs into existing bridges and liquidity channels, JUSTSWAP makes cross-chain swaps feel simple and seamless. You still benefit from decentralisation, but without the usual pain points.

You no longer have to think about what’s happening under the hood. JUSTSWAP does that for you.

Building the Future, Today

The long-term vision?

A world where assets move freely across chains, no wrapping, no locking, no centralised validators. Where liquidity flows natively, and users stay in control at all times.

We’re not there yet.

But GVNR is building towards that future, and JUSTSWAP is a major step on that journey.

Core Features of JUSTSWAP:

Unified cross-chain interface - No more jumping between dApps or managing multiple wallets.

Simplified user experience - You hold USDC on Base. You want USDC on Solana. Normally? You’d bridge, wrap, and redeem. With JUSTSWAP? One click, and it’s done for you.

Bridge infrastructure, abstracted away - Bridges are still used behind the scenes, but you don’t have to touch them.

Liquidity Aggregation Across Networks - Instead of relying on isolated liquidity pools, JUSTSWAP aggregates liquidity across chains, ensuring better pricing and execution.

Secure & Trustless Transactions - JUSTSWAP uses a decentralised execution model, meaning no centralised relayers or intermediaries hold your assets. Every swap is executed on-chain, fully transparent, and verifiable by users. No magician's cloak shields you from what is really going on, you can see it all in real time.

No Wrapped Assets or Synthetic Tokens - Most cross-chain swaps today rely on wrapped or synthetic assets, essentially IOUs that depend on trusted third parties to redeem. JUSTSWAP doesn’t remove that infrastructure (yet), but it makes it invisible. By aggregating liquidity from different bridges and networks into a single interface, JUSTSWAP lets users swap for the correct native asset on the target chain, without having to manually interact with the underlying mechanics.

You’re not minting a wrapped version yourself.

You’re simply getting what you asked for, USDC for USDC, SOL for SOL, ETH for ETH, delivered through a clean, consistent experience.

It’s not “bridge-free”currently, but it feels like it, and that’s a huge step forward for usability in DeFi.

Integration with the GVNR Ecosystem - Users who swap on JUSTSWAP earn OG Points, contributing to their ranking within the GVNR system.

More swaps = higher OG status = better rewards in the ecosystem.

The CoinList Incentivised Launch Campaign offers 25 OG Points per swap with no upper limit - the more you trade, the more points you accumulate, directly increasing your potential $GVNR airdrop allocation. Users can maximize their rewards by making frequent swaps of at least $1 in value across any supported token or blockchain. By accumulating OG Points, participants climb the campaign leaderboard, competing for a share of 200,000 $GVNR tokens that will be distributed to the most active traders.

Liquidity fragmentation has slowed DeFi adoption for too long. JUSTSWAP removes the friction, security risks, and inefficiencies that have plagued cross-chain transactions. No middlemen, no unnecessary risks, just seamless, borderless finance.

The next phase of DeFi isn’t about patching broken models or building on the wooden stilts that have come before. It’s about building on solid long-term foundations that can support the next evolution of the financial world.

Disclaimer:

The information provided by GVNR is for informational purposes only and should not be considered financial, investment, or legal advice. GVNR makes no guarantees regarding accuracy or reliability.

NFA & DYOR: Nothing shared is financial advice. Always conduct your own research and consult a professional before making decisions. GVNR is not liable for any losses or outcomes resulting from actions taken based on this content.